Essential Guide to Navigating FBAR Reporting with Multiple Foreign Accounts

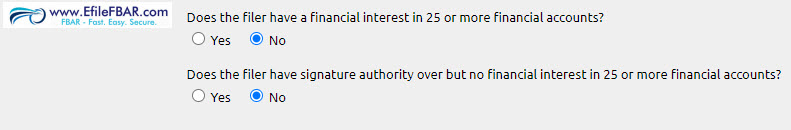

As an American residing abroad or possessing financial stakes across borders, reporting your foreign bank and financial accounts becomes a vital compliance task. This extensive guide concentrates on the subtleties of managing and reporting over 25 foreign bank accounts under the Foreign Bank and Financial Accounts Report (FBAR) framework, embellishing your understanding and confidence in handling this intricate responsibility.

What is FBAR and Its Significance?

FBAR, or FinCEN Form 114, serves as a tool for the U.S. government to prevent financial fraud and maintain high standards of financial transparency. It's a mandatory disclosure for U.S. persons with an aggregate value exceeding $10,000 in foreign financial accounts at any point within the calendar year. Neglecting this duty can lead to severe penalties, underscoring the importance of meticulous reporting.

Key Aspects to Consider in FBAR Reporting

Here are ten critical considerations for managing your FBAR obligations effectively:

- Understanding the threshold: If the total value of your foreign accounts exceeded $10,000 at any time, FBAR reporting is required.

- Determining who must file: U.S. persons, including individuals and entities with ownership or control over foreign financial accounts, are obligated to file.

- Knowing what to report: Bank accounts, securities accounts, and other non-account financial instruments should be disclosed.

- Grasping the filing requirements for joint accounts: Special attention is needed to accurately report jointly held foreign accounts.

- Being aware of the filing deadline: FBARs are due by April 15, with an automatic extension to October 15, no separate request required.

- Filing electronically: FBAR must be submitted through the BSA E-Filing System, ensuring accuracy and timely compliance.

- Record-keeping: Keep detailed records of all foreign financial accounts for at least five years from the FBAR due date.

- Understanding the penalties for non-compliance: Potential implications range from civil penalties to criminal charges.

- Seeking professional help: When in doubt, consulting with a specialist in FBAR reporting can provide peace of mind and ensure compliance.

- Using available resources: The FinCEN and IRS websites offer comprehensive guidance and resources for filers.

Frequently Asked Questions (FAQs)

How do I handle FBAR reporting for multiple foreign accounts?

Consolidate your records and ensure each account that meets the threshold is reported, regardless of the number. Employing software or a specialist can streamline this process.

Can filing deadlines be extended?

Yes, there's an automatic extension to October 15. However, staying ahead of deadlines is crucial for peace of mind and avoiding last-minute errors.

Is professional assistance necessary?

While not mandatory, professional guidance can be invaluable, especially for those with complex portfolios or navigating FBAR for the first time.

In conclusion, adeptly navigating FBAR reporting, especially when managing 25 or more foreign financial accounts, demands a comprehensive understanding, meticulous attention to detail, and a proactive approach. It's not just about compliance; it's about ensuring the financial integrity and security of your international engagements. With the right mindset and resources, you can transform this obligation into a seamless aspect of your financial management routine. Remember, the main advantage lies in maintaining compliance and peace of mind, knowing you're fulfilling your responsibilities as a conscientious global citizen. Take action today to ensure you're on the right track.